| LAMPIRAN I | |||

| PERATURAN DIREKTUR JENDERAL PAJAK | |||

| NOMOR | : | PER-40/PJ/2010 | |

| TENTANG | : | PENGEMBALIAN KELEBIHAN PEMBAYARAN PAJAK YANG SEHARUSNYA TIDAK TERUTANG BAGI WAJIB PAJAK LUAR NEGERI | |

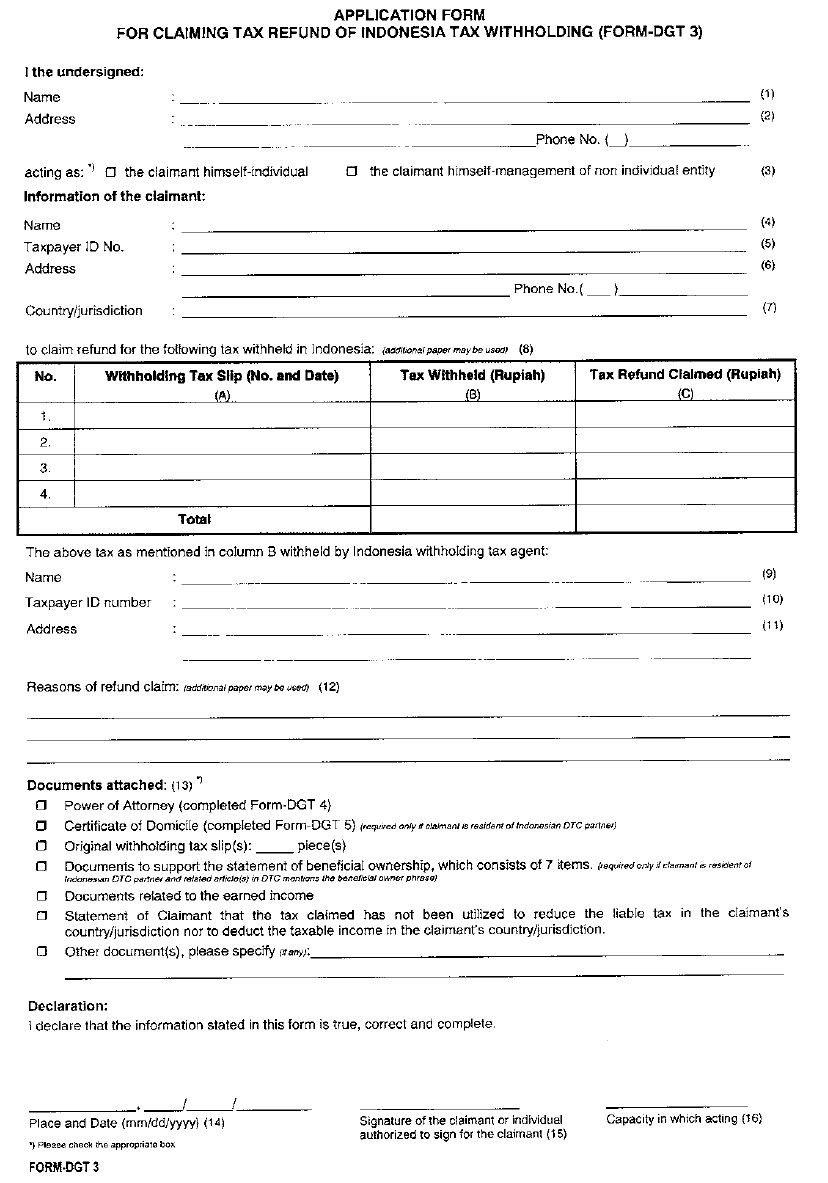

| INSTRUCTIONS FOR APPLICATION FORM FOR CLAIMING TAX REFUND OF INDONESIA TAX WITHHOLDING (FORM-DGT 3) |

General Information :

| 1. | Non

resident who has been withheld income tax by Indonesia withholding tax

agent may claim tax refund to the Director General of Taxes, in case :

|

||||||||||||||

| 2. | The application must be made by non resident taxpayer who claims the refund ("the Claimant") and must be submitted through the Indonesia withholding tax agent. | ||||||||||||||

| 3. | One application must be made for any tax claims related to one withholding tax agent. | ||||||||||||||

| 4. | The Claimant must grant a specific power of attorney to the withholding tax agent to lodge the application to the Director General of Taxes and to provide a bank account which will be used to transfer the approved tax refund. | ||||||||||||||

| 5. | Documents and information that are required to be provided by the Claimant (please read the related instructions for details) :

|

||||||||||||||

| 6. | Director General of Taxes shall give a decision not more than 3 (three) months since the application is lodged completely. Should the application is refused ; a written notification will be sent to the Claimant through the withholding tax agent. | ||||||||||||||

| 7. | An Overpayment Tax Assessment Letter (SKPLB) will be issued for approved claim to process the refund transfer to the withholding tax agent's bank account. For transferring any tax refund, it is required a bank account, Rupiah currency, in any bank that is situated in Indonesia. |

Guidance to fill the application :

Form-DGT 3 is downloadable at http://www.pajak.go.id:

Number 1 :

Please fill in the name of individual who signs this form. For individual, please fill in the name of the Claimant . For non individual entity, please fill in the name of individual who may act as the representative of the Claimant.

Number 2:

Please fill in the address of individual who signs this form.

Number 3:

Please check the appropriate box.

Number 4 to 6 :

This section must be filled with information of the Claimant whose income is withheld by Indonesia withholding tax agent.

(4) Please fill in the Claimant's name.

(5) Please fill in the Claimant's taxpayer identification number in country/jurisdiction where the claimant registered as a taxpayer resident.

(6) Please fill in the Claimant's address.

(7) Please fill in the country/jurisdiction where the claimant registered as a taxpayer resident.

Number 8 :

Please fill in the column (A) with the number and date of withholding tax slip(s) issued by withholding tax agent, column (B) with the amount of tax withheld as stated in the withholding tax slip (in Rupiah) and column (C) with the amount of tax claimed (in Rupiah).

Please total the amount of column (B) and (C) respectively.

Additional paper may be used.

Number 9-11 :

This section requires the claimant to fill in the information regarding Indonesia withholding tax agent. You may refer to information provided in withholding tax slips .

(9) Please fill in the name of the withholding tax agent.

(10) Please fill in the taxpayer identification number (NPWP) of the withholding tax agent.

(11) Please fill in the address of the withholding tax agent.

Number 12:

Please provide reasons to claim the tax withheld and any articles of the Double Tax Convention (DTC) which relevant or related to the claim. The Claimant may state his reasons and arguments to support that the tax withheld is not in accordance with the Indonesian income tax law and/or the DTC. Additional paper may be used by the claimant.

Number 13 :

Please check the appropriate box to declare that the Claimant has completed all the requirements.

Notes: The failure to present the following attachment will cause the Director General of Taxes to refuse the application.

| a. | Power of Attorney (completed Form-DGT 4). The form is downloadable at http ://www.pajak.go.id The Claimant must provide a specific power of attorney to grant power to the withholding tax agent to submit the application and to provide a bank account number. This document is liable to Indonesian stamp duty (IDR 6,000) according to the Law No. 13 Year 1985. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| b. | Certificate of Domicile (completed Form-DGT 5). The form is downloadable at http://www.pajak.go.id. This form is required to be submitted for the application of the DTC. The form of certificate of domicile, issued by the Directorate General of Taxes and must be filled completely and signed by the Claimant. The first page of this certificate must be authorized by the Competent Authorities, his representative or authorized tax office in country/jurisdiction where the Claimant is registered as a taxpayer resident. In case the competent authority, his authorized representative, or the authorized tax office cannot put his authorization in this form, the Claimant may submit the certificate of domicile, as an attachment of Form-DGT 5, which is usually issued in the Claimant's country/jurisdiction and such certificate shall meet the requirements as provided in the instruction of Form-DGT 5. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| c. | Original withholding tax slip(s). The Claimant must provide the original withholding tax slips to support the information provided in Number 8. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| d. | The Claimant statement that the tax claimed has not been utilized to reduce the liable tax nor to deduct the taxable income in calculating the liable tax in the Claimant's country/jurisdiction. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| e. | Document(s) related to the earned income.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| f. | Documents to support the statement of beneficial ownership These documents are required to be submitted by the claimant who is a resident in country/jurisdiction that has concluded DTC with Indonesia and the related article in DTC mentions the beneficial owner phrase. To support that the Claimant is the beneficial owner of the income, the following information (7 items) must be provided as attachment of the application (completed Form-DGT 3) :

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| g. | Other documents The Claimant or the withholding tax agent may attach documents other than the required documents mentioned above to support the claim . |

Notes:

| a. | In case the

tax claimed by the Claimant is resulted from mutual agreement agreed by

both Competent Authorities through a Mutual Agreement Procedures, the

claimant is only required to submit the following documents :

|

||||||||

| b. | In case the

Claimant is not a resident taxpayer of a country/jurisdiction which has

concluded DTC with Indonesia, the Claimant is only required to submit

the following documents :

|

Number 14:

Please fill in the venue and date of signing.

Number 15:

The Claimant or the representative must sign the form.

Number 16:

Please fill in the capacity of the Claimant or the representative who signs this form.

| LAMPIRAN II | |||

| PERATURAN DIREKTUR JENDERAL PAJAK | |||

| NOMOR | : | PER-40/PJ/2010 | |

| TENTANG | : | PENGEMBALIAN KELEBIHAN PEMBAYARAN PAJAK YANG SEHARUSNYA TIDAK TERUTANG BAGI WAJIB PAJAK LUAR NEGERI | |

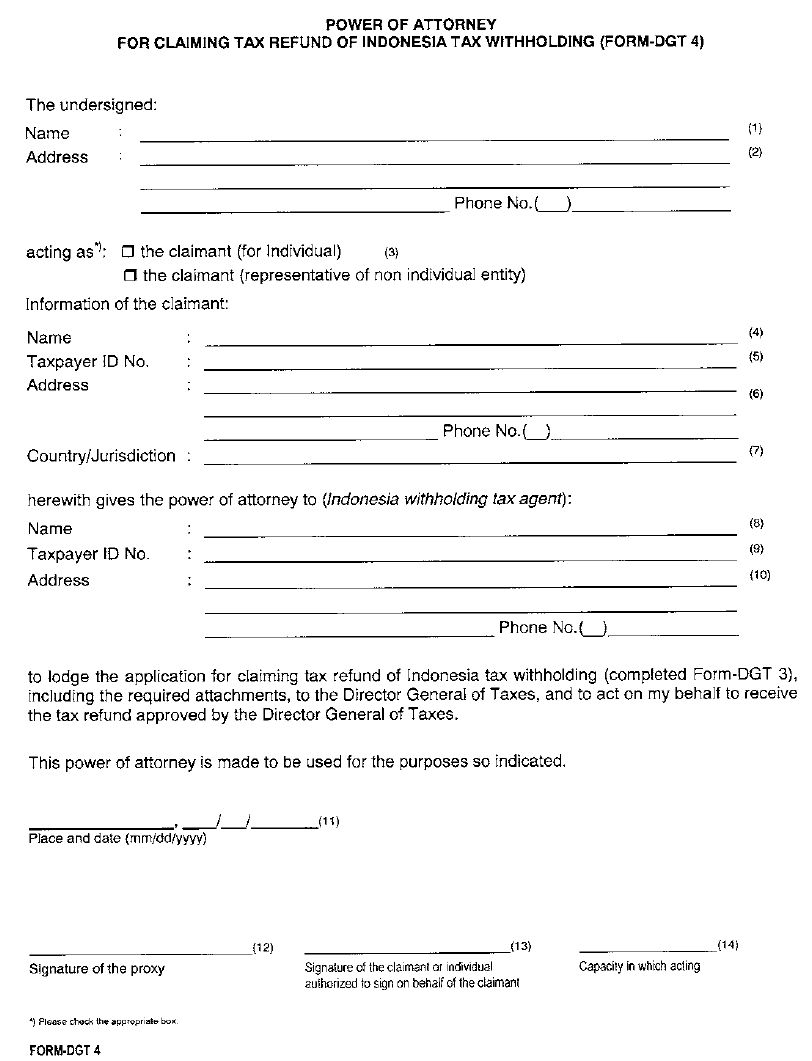

| INSTRUCTIONS FOR FORM OF POWER OF ATTORNEY (FORM-DGT 4) |

General information :

This form is one of the required documents which granting a power of attorney to Indonesia withholding tax agent to lodge the refund application (completed Form-DGT 3) and all required attachments and to act on behalf the Claimant to receive any tax refund approved by the Director General of Taxes.

It is required to provide an account in any bank situated in Indonesia in Indonesia Rupiah (IDR) currency.

Guidance to fill this form :

Number 1 :

Please fill in the name of individual who signs this form. For individual, please fill in the name of the Claimant. For non individual entity, please fill in the name of individual who may act as the representative of the entity.

Number 2 :

Please fill in the address of individual who will sign the power of attorney.

Number 3 :

Please check the appropriate box .

Number 4:

Please fill in the Claimant's name. If the Claimant is an individual, the name is as it is filled in Number 1.

Number 5:

Please fill in the Claimant's taxpayer identification number in country/jurisdiction where the claimant registered as a taxpayer resident.

Number 6:

Please fill in the claimant's address .

Number 7:

Please fill in the country/jurisdiction where the claimant registered as a taxpayer resident.

Number 8-10 :

Please fill in the information of Indonesia withholding tax agent who receives the power of attorney. The information may be appeared in the withholding tax slip.

(8) Please fill in the name of the withholding tax agent,

(9) Please fill in the taxpayer identification number (NPWP),

(10) Please fill in the address.

Number 11 :

Please fill in the venue and date of signing.

Number 12 :

The person who receives the power of attorney must sign this form.

Number 13:

The Claimant, or the representative of non individual claimant, must sign this form.

Number 14:

Please fill in capacity of the Claimant who signs this form. In case the signor is the representative, please fill in the capacity of the signor.

Note :

The Power of Attorney is liable to Indonesian stamp duty (IDR 6,000) according to Law No. 13 Year 1985.

| LAMPIRAN III | |||

| PERATURAN DIREKTUR JENDERAL PAJAK | |||

| NOMOR | : | PER-40/PJ/2010 | |

| TENTANG | : | PENGEMBALIAN KELEBIHAN PEMBAYARAN PAJAK YANG SEHARUSNYA TIDAK TERUTANG BAGI WAJIB PAJAK LUAR NEGERI | |

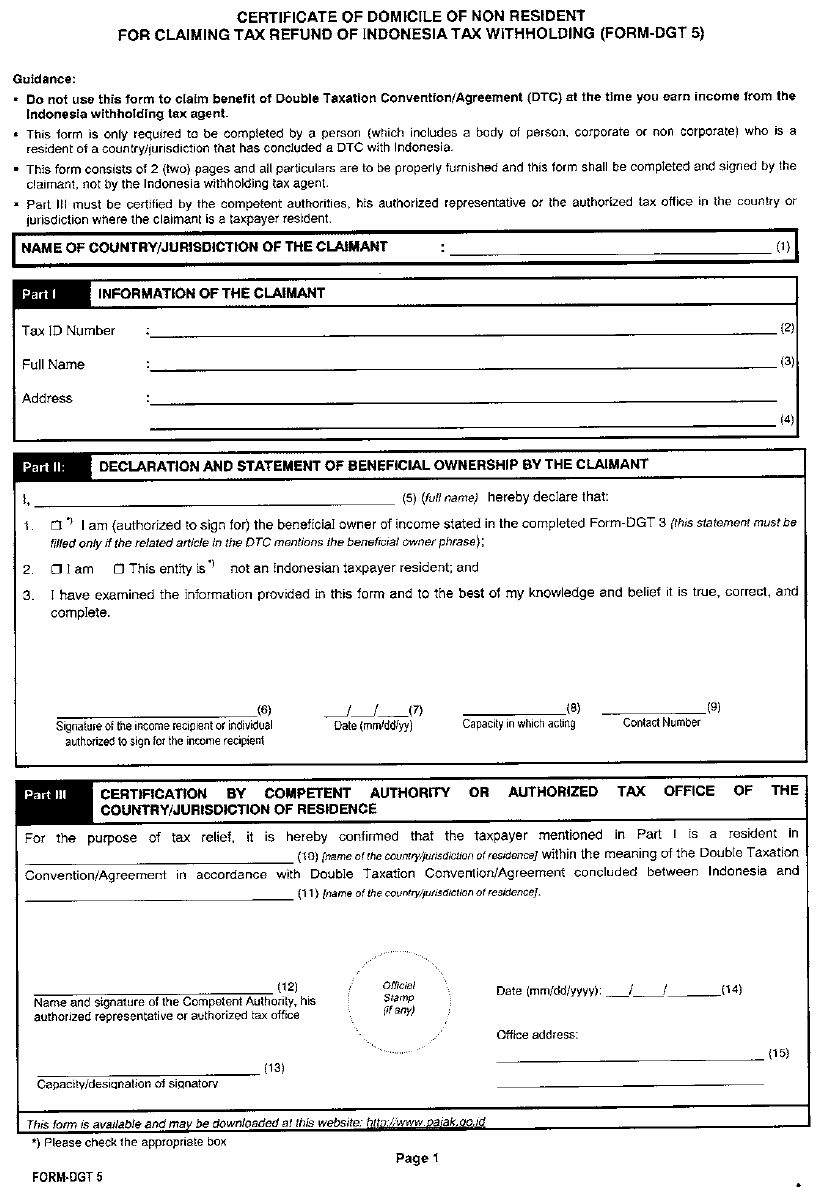

| INSTRUCTIONS FOR CERTIFICATE OF DOMICILE OF NON RESIDENT FOR CLAIMING TAX REFUND OF INDONESIA TAX WITHHOLDING (FORM-DGT 5) |

General information :

| 1. | This form is only required for the Claimant whose country/jurisdiction has concluded Double Taxation Convention/Agreement (DTC) with Indonesia. | ||||||||

| 2. | This form

consists of 2 (two) pages . The first page consists of the Claimant

declaration and authorization by the Competent Authority or authorized

tax office in the Claimant's country/jurisdiction concerning the status

of the Claimant's residency. After the Claimant fills this form completely please bring the first page to the competent authority or authorized tax office for authorization. In case the competent authority or the authorized tax office cannot put his authorization in this form, the Claimant may submit the certificate of domicile, as an attachment of Form- DGT 5, which is usually issued in the Claimant's country/jurisdiction and such certificate shall meet the requirements as provided in the instruction of Form-DGT 5:

|

Guidance to fill this form :

Number 1 :

Please fill in the name of country/jurisdiction of the Claimant.

Part I Information of Claimant :

Number 2:

Please fill in the Claimant's taxpayer identification number in country where the Claimant is registered as a resident taxpayer . Please type "n .a ." in case the country/jurisdiction of the Claimant does not provide taxpayer identification number for resident taxpayers.

Number 3:

Please fill in the Claimant's name .

Number 4:

Please fill in the Claimant's address .

Part II Declaration by the Claimant :

Number 5:

Please fill in the name of person who authorized to sign on behalf the Claimant.

If the Claimant is not an individual, this form must be filled by individual who may act as representative of the non individual entity .

If the Claimant is an individual, please fill in the name as stated in Number 3 .

Important :

The Claimant is required to state :

| a. | whether the Claimant is the beneficial owner of income. The phrase beneficial owner is commonly contained in article of DTC related to the income of dividend, interest, royalties and capital gain (sometimes). It is highly recommended to the Claimant to check article in DTC related to the income. In case the Claimant is not the beneficial owner, do not check the box; |

| b. | whether the Claimant is the Indonesian taxpayer resident. Do not check the box if the Claimant is Indonesian resident taxpayer. |

Number 6:

The Claimant or his representative (for non individual) must sign this form.

Number 7:

Please fill in the date of signing.

Number 8:

Please fill in the capacity of the Claimant or his representative who signs this form.

Number 9:

Please fill in the contact number of person who signs this form .

Part III Certification by competent authority of the country of residence :

In case the Competent Authority, His authorized representative or the authorized tax office cannot put his authorization in this form, the Claimant may leave blank this Part. Then, the Claimant must attach the certificate of domicile, which is commonly issued in the Claimant's country/jurisdiction, to the completed Form-DGT 5.

Number 10 and 11 :

Please fill in the name of country/jurisdiction where the Claimant is resident taxpayer.

Number 12 and 13

The Competent Authorities, his authorized representative, or authorized tax office certifies this form by signing it . The position of the signor should be filled in Number 13.

Number 14:

Please fill in the date when the form is signed by the competent authority, his authorized representative or authorized tax office

Number 15:

Please fill in the office address of the competent authority, authorized representative or authorized tax office.

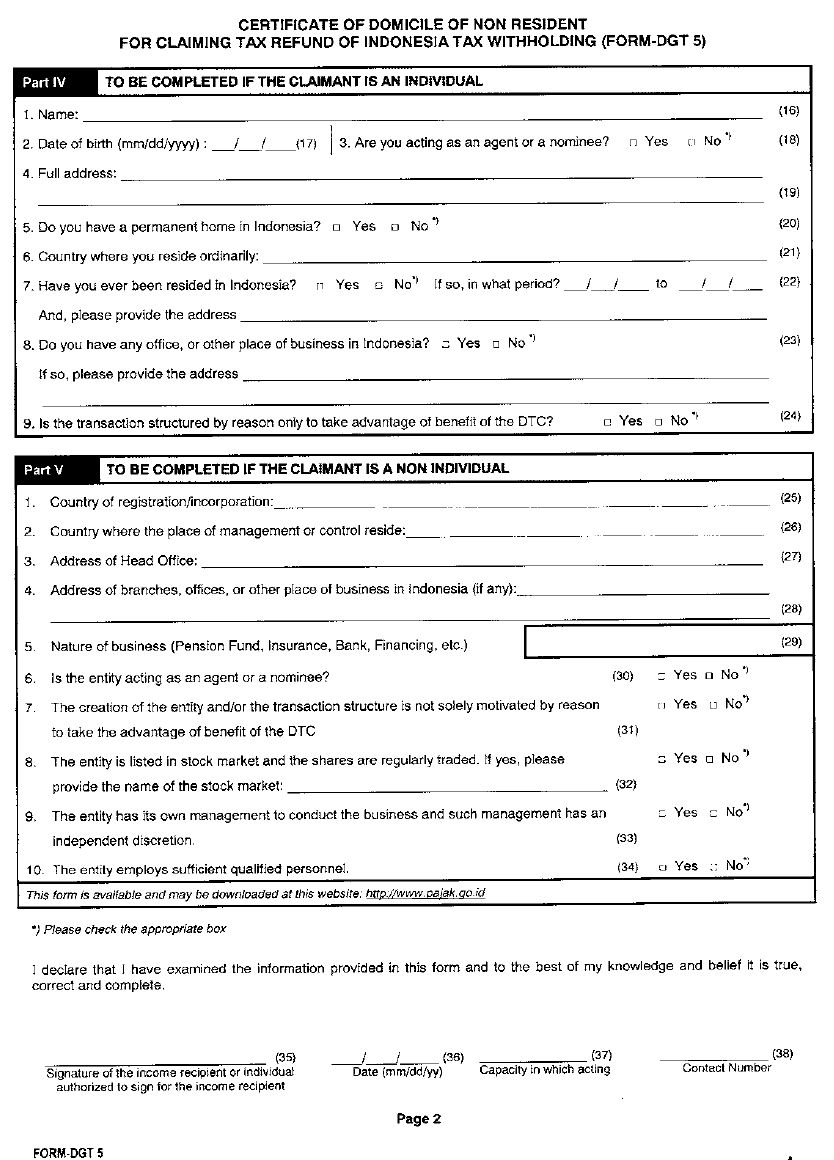

Part IV To be completed if the Claimant is an Individual :

Number 16:

Please fill in the Claimant's full name.

Number 17:

Please fill in the Claimant's birthday.

Number 18:

Please check the appropriate box. You are considered acting as an agent if you act as an intermediary or acting for and on behalf of other party in relation with the income source in Indonesia. You are considered acting as a nominee if you are the legal owner of income or of assets that the income is generated but not the real owner of the income or assets.

Number 19:

Please fill in the Claimant's address.

Number 20:

Please check the appropriate box. If the Claimant's permanent home is in Indonesia, you are considered as Indonesian taxpayer resident in accordance with the Indonesian Income Tax Law. In that case the DTC cannot be applied to the Claimant.

Number 21 :

Please fill the name of country where the Claimant ordinarily resides .

Number 22:

Please check the appropriate box. In case the Claimant has ever been resided in Indonesia, please fill the period of your stay and address where you resided.

Number 23:

Please check the appropriate box. In case the Claimant has any offices, or other place of business in Indonesia, please fill in the address of office or other place of business in Indonesia.

Number 24:

Please state whether or not the Claimant's motivation in structuring the transaction related to the earned income is solely to take advantage of benefit of the DTC.

Part V To be Completed if the Claimant is non Individual :

Number 25:

Please fill in the country/jurisdiction where the entity is registered or incorporated.

Number 26:

Please fill in the country where the entity is controlled or where its management is situated.

Number 27:

Please fill in the address of the entity's head office.

Number 28:

Please fill in the address of any branches, offices or other place of business of the entity situated in Indonesia.

Number 29:

Please fill in the nature of business of the Claimant.

Number 30-38 :

Please check the appropriate box in accordance with the Claimant's facts and circumstances.

(30) Please check "No" if the entity, in relation with the earned income, is acting as an agent or a nominee . The meaning of agent or nominee is mentioned in Number 18.

(31) Please state whether or not motivation of the Claimant related to the earned income is solely to take advantage of benefit of the DTC.

(32) Please state whether or not the entity is listed in stock market and, if so, please type the name of the stock market.

(33) Please state whether the entity has its own management to conduct the business and such management has an independent discretion.

(34) Please state whether the entity employs sufficient qualified personnel.

Number 35:

The Claimant or his representative (for non individual) must sign this form.

Number 36:

Please fill in the date of signing.

Number 37:

Please fill in the capacity of the Claimant or his representative who signs this form.

Number 38:

Please fill in the contact number of person who signs this form.

| INSTRUCTIONS FOR CERTIFICATE OF DOMICILE OF NON RESIDENT FOR CLAIMING TAX REFUND OF INDONESIA TAX WITHHOLDING (FORM-DGT 5) |

General information :

| 1. | This form is only required for the Claimant whose country/jurisdiction has concluded Double Taxation Convention/Agreement (DTC) with Indonesia. | ||||||||

| 2. | This form

consists of 2 (two) pages. The first page consists of the Claimant

declaration and authorization by the Competent Authority or authorized

tax office in the Claimant's country/jurisdiction concerning the status

of the Claimant's residency. After the Claimant fills this form completely please bring the first page to the competent authority or authorized tax office for authorization. In case the competent authority or the authorized tax office cannot put his authorization in this form, the Claimant may submit the certificate of domicile, as an attachment of Form-DGT 5, which is usually issued in the Claimant's country/jurisdiction and such certificate shall meet the requirements as provided in the instruction of Form-DGT 5 :

|

Guidance to fill this form :

Number 1 :

Please fill in the name of country/jurisdiction of the Claimant.

Part I Information of Claimant :

Number 2 :

Please fill in the Claimant's taxpayer identification number in country where the Claimant is registered as a resident taxpayer. Please type "n .a ." in case the country/jurisdiction of the Claimant does not provide taxpayer identification number for resident taxpayers.

Number 3:

Please fill in the Claimant's name.

Number 4:

Please fill in the Claimant's address.

Part II Declaration by the Claimant :

Number 5 :

Please fill in the name of person who authorized to sign on behalf the Claimant.

If the Claimant is not an individual, this form must be filled by individual who may act as representative of the non individual entity.

If the Claimant is an individual, please fill in the name as stated in Number 3.

Important :

The Claimant is required to state :

| a. | whether the Claimant is the beneficial owner of income. The phrase beneficial owner is commonly contained in article of DTC related to the income of dividend, interest, royalties and capital gain (sometimes). It is highly recommended to the Claimant to check article in DTC related to the income. In case the Claimant is not the beneficial owner, do not check the box; |

| b. | whether the Claimant is the Indonesian taxpayer resident. Do not check the box if the Claimant is Indonesian resident taxpayer. |

Number 6:

The Claimant or his representative (for non individual) must sign this form.

Number 7:

Please fill in the date of signing.

Number 8:

Please fill in the capacity of the Claimant or his representative who signs this form.

Number 9:

Please fill in the contact number of person who signs this form.

Part Ill Certification bV competent authority of the country of residence :

In case the Competent Authority, His authorized representative or the authorized tax office cannot put his authorization in this form, the Claimant may leave blank this Part. Then, the Claimant must attach the certificate of domicile, which is commonly issued in the Claimant's country/jurisdiction, to the completed Form-DGT 5.

Number 10 and 11 :

Please fill in the name of country/jurisdiction where the Claimant is resident taxpayer.

Number 12 and 13

The Competent Authorities, his authorized representative, or authorized tax office certifies this form by signing it . The position of the signor should be filled in Number 13.

Number 14 :

Please fill in the date when the form is signed by the competent authority, his authorized representative or authorized tax office

Number 15:

Please fill in the office address of the competent authority, authorized representative or authorized tax office.

Part IV To be completed if the Claimant is an Individual :

Number 16:

Please fill in the Claimant's full name.

Number 17 :

Please fill in the Claimant's birthday.